Which of the Following Are Most Likely Fixed Costs

None of the above. Wages for unskilled labour D.

Average Fixed Cost Definition Formula Example Curve

Which of the following is most likely a fixed cost.

. Which of the following is most likely to be a fixed cost. Cannot be determined from the above. Which of the following is most likely a fixed cost.

Which of the following is most likely a fixed cost. Shipping charges on the other hand always change depending on the. Which of the following is most likely a fixed cost.

None of the above. Cost of raw materials for production. In the long run a.

All costs are variable. Expenditures for raw materials B. What are the fixed costs of a business.

Which of the following is most likely to be a fixed cost of a manufacturing company. This is usually fixed from month to month and is among the first things to come out of a paycheck or out of the profits made from a business. The rent for a factory.

Group of answer choices. Which of the following is most likely to be a fixed cost for a business. 2 Which of the following is most likely a variable cost.

Labor and raw materials costs. These are multiyear organizational investments that cannot be easily changed. Answer of Which of the following is most likely to be a fixed cost.

The use of operating leverage a. The material used to make jackets. This implies that its MC is A.

What is most likely to be a fixed cost for a business. A Depreciation taken on an office building B Wages for production workers C Interest. Power consumed in the factory.

All costs are fixed. Biv LLC reports total contribution margin of 98800 and pretex net income of 24700 for the current month. A sales representative commissions B product distribution costs C manufacturing input costs D temporary worker salaries E facility rental payments.

Wages for unskilled labor C. The electricity used to run packaging equipment. Requires the firm to have only variable costs c.

Which of the following is most likely a fixed cost. Wages for unskilled labor d. Shipping charges for the delivery of products C.

Salary and Allowances paid to office staff. Which of the following is most likely to be fixed cost. Increases the breakeven level d.

Which of the following is most likely a variable cost. Shipping charges for the delivery of products D. Wages paid to factory workers.

Property insurance premiums C. A Incometaxes B The cost of merchandise sold C Depreciation taken on equipment D The cost of commissioned sales people E Alloftheabove. Which of the following are most likely fixed costs.

All costs are fixed. Which of the following is most likely to be a fixed cost for a business in the Short Run. All costs are variable.

Which of the following is most likely a variable cost. The only cost on here likely to be a fixed cost is how much you pay in rent. Which of the following is most likely a fixed cost.

Requires a teeter totter to be installed in the office b. Depreciation taken on an office building b. Wages paid to factory workers.

Direct labor Tires Screws Handle bar Rent OOOOO Roy G. The cost of material used in production. Which of the following is most likely a fixed cost.

Expenditures for raw materials. The labor on an automotive assembly line. None of the above.

Which of the following is most likely to be a fixed cost. Payment for raw materials used in manufacturing goods B. Which of the following costs are most likely to be classified as fixed for a bicycle manufacturer.

Expenditures on raw materials b. For a building company for example it would fixed be because the production number is an independent variable so it would be the same insurance cost per build whatever the output is. Expenditures on low-skill labor B.

Insuring a property is more likely to be a fixed cost because it relates to value of fixed assets and to a contract. Expenditures for raw materials b. Paying a monthly budget amount for utilities is a fixed cost.

An Accountant who is studying for his part time MBA had to give up one day salary of every week to attend the MBA classes. At any given rate of output the difference between total cost and fixed cost is. Property tax is a fixed expenditure for business.

Wages paid to temporary workers. All costs are mixed. When a firm increased its output by one unit its AC rose from 45 to 50.

Interest on corporate bonds d. Electricity to operate factory machines Factory insurance Factory rent Administrative salaries. Cost of materials commissions and assembly labor costs are going to change depending on the nature of what is going on from one month to the next.

1Which of the following is most likely to be a fixed cost. Wages for unskilled labor c. In the short run which of the following is most likely a variable cost.

Wages for production workers c. All costs are mixed. Power consumed in the factory.

Property taxes on the firms buildings E. Eliminates all fixed costs e. Salary insurance property taxes interest expenses depreciation and possibly some utilities are all examples of fixed costs.

Rent on an office building e. Property insurance premiums c. Interest payments today on a loan taken out last year to finance the construction of a new building for a business C.

Salary and Allowances paid to office staff. See the answer See the answer done loading. Depreciation taken on equipment d.

What is most likely an example of a committed fixed cost. An Accountant who is studying for his part time MBA had to give up one day salary of every week to attend the MBA classes. The correct answer is.

Wages for production workers c. Between 45 and 50. Up to 25 cash back 1.

Fixed And Variable Costs Overview Examples Applications

Operating Leverage Formula And Excel Calculator

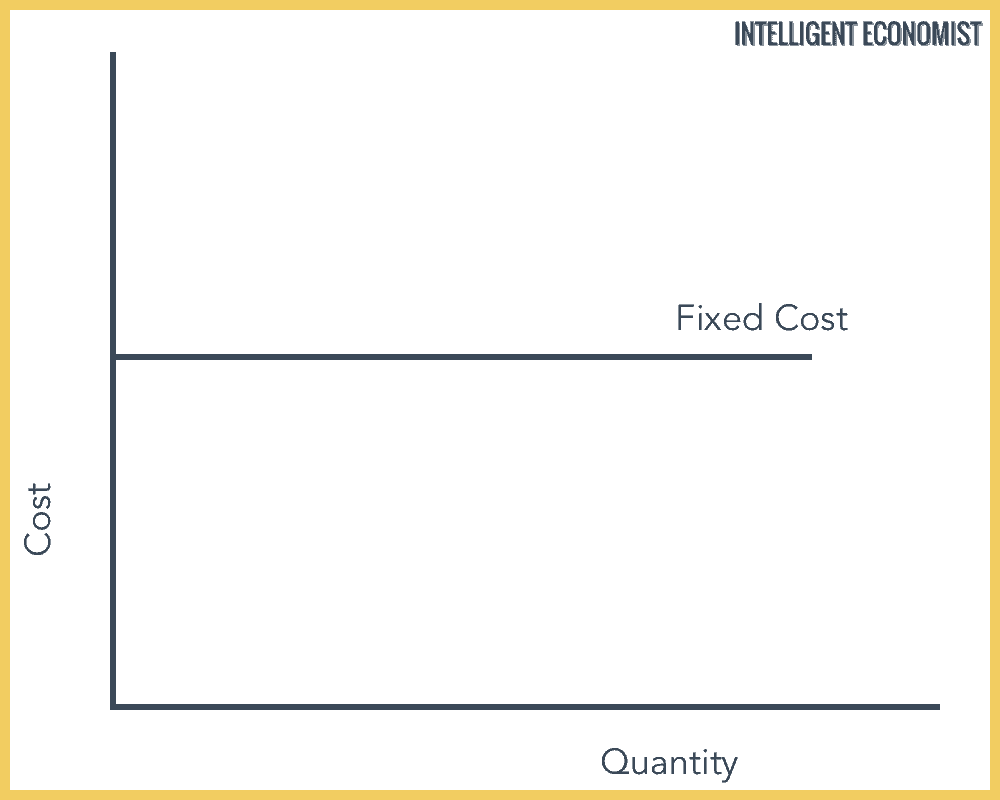

Theory Of Production Cost Theory Intelligent Economist

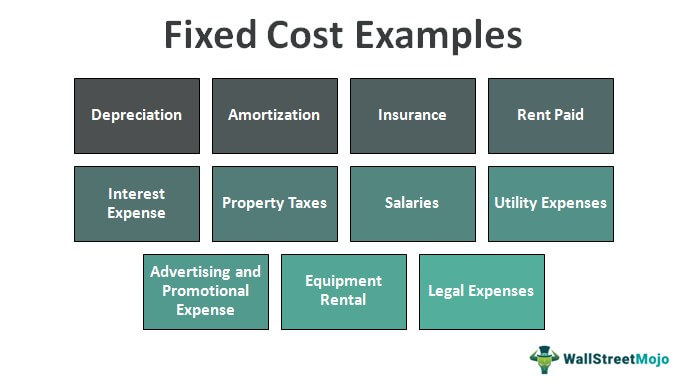

Fixed Cost Examples Top 11 Examples Of Fixed Cost With Explanation

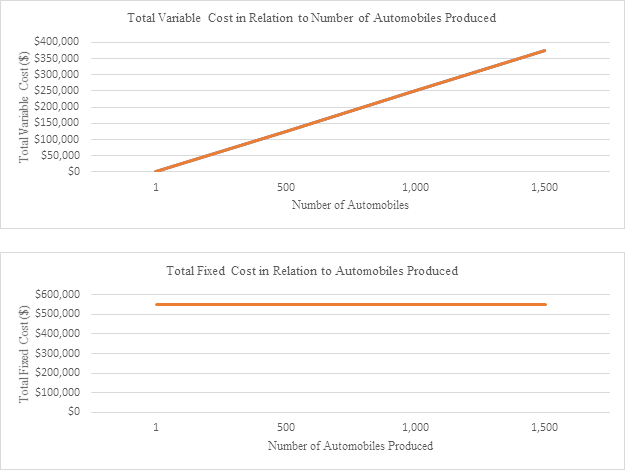

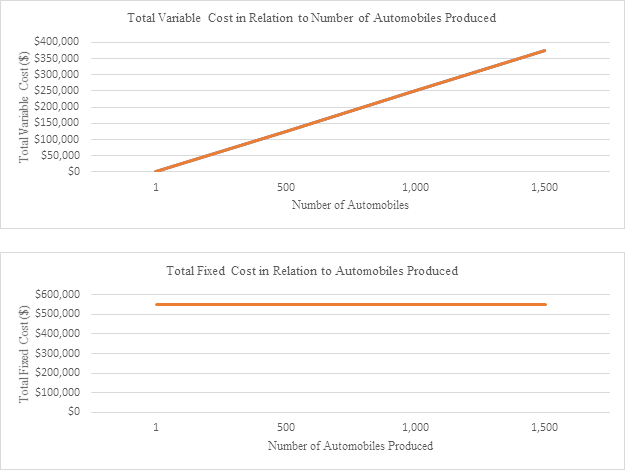

Fixed And Variable Costs Overview Examples Applications

How Much Does A Wedding Actually Cost In 2021 Wedding Costs Wedding Hotel Wedding

No comments for "Which of the Following Are Most Likely Fixed Costs"

Post a Comment